Product Description

A statement of deposits that a CCB outlet issues at the request of an applicant, whether a Chinese resident or non-resident (including foreign citizens, foreign nationals of Chinese descent, and residents of Hong Kong, Macau and Taiwan), states the applicant’s deposits at CCB within a specified time, or the certificate treasury bonds the applicant purchased at CCB. A CCB statement of deposits may only be issued on CCB RMB or foreign currency CDs, bankbooks, bankcards certificate treasure bonds, or other certificates of rights.

Three major reasons for selecting CCB’s statement of deposits

1. Credibility. CCB is a well-known international bank with good reputation. The statement of deposit issued by CCB is highly recognized by the public and the foreign embassies in China.

2. Covering a wide range of deposits in different currencies. CCB may issue a single statement listing all your deposits on different accounts, such as the treasury bonds you purchased through CCB. The service can meet your personalized needs and save considerable costs for you.

3. CCB adopted high-tech anti-counterfeit technologies. The statement of deposit is well printed, which can reflect your credit standing.

Features:

1. The statement of deposits can be used to prove that you have a certain amount of RMB or foreign currency deposits at CCB.

2. The statement of deposits can also be used to prove that you have purchased a certain amount of certificate treasury bond or other rights at CCB.

Service channels:

CCB’s outlets

Special Notes

A statement of deposits states the amount of a Chinese resident or non-resident’s deposits at CCB within a specified time, or of certificate treasury bonds he or she purchased at CCB. It is not negotiable or transferable. It may not be used as collateral. Its loss may not be reported to CCB. It does not serve as title and may not be used for withdrawals, transfers, renewals or currency exchanges.

CCB may not issue a statement of deposits of assets frozen by competent courts above the county level, or assets with a lien on them and frozen by banks.

Assets based on which a statement of deposits is issued may not be used to secure loans. Before a statement of deposits expires, deposits or certificate treasury bonds based on which it is issued may not be withdrawn or exchanged.

Currencies and Terms

A statement of deposits may be issued for deposits in any currency. The minimum term is seven days.

Fee

A fee of 20 RMB is charged for each copy. If the applicant requests a change in the expiration date, a fee of 20 RMB is charged for each new copy.

Client Process

An applicant, or an agent of the applicant, should visit the outlet where the account was opened, present the original copy of acceptable identification and title to assets, and file an Application for a Statement of Deposits at CCB.

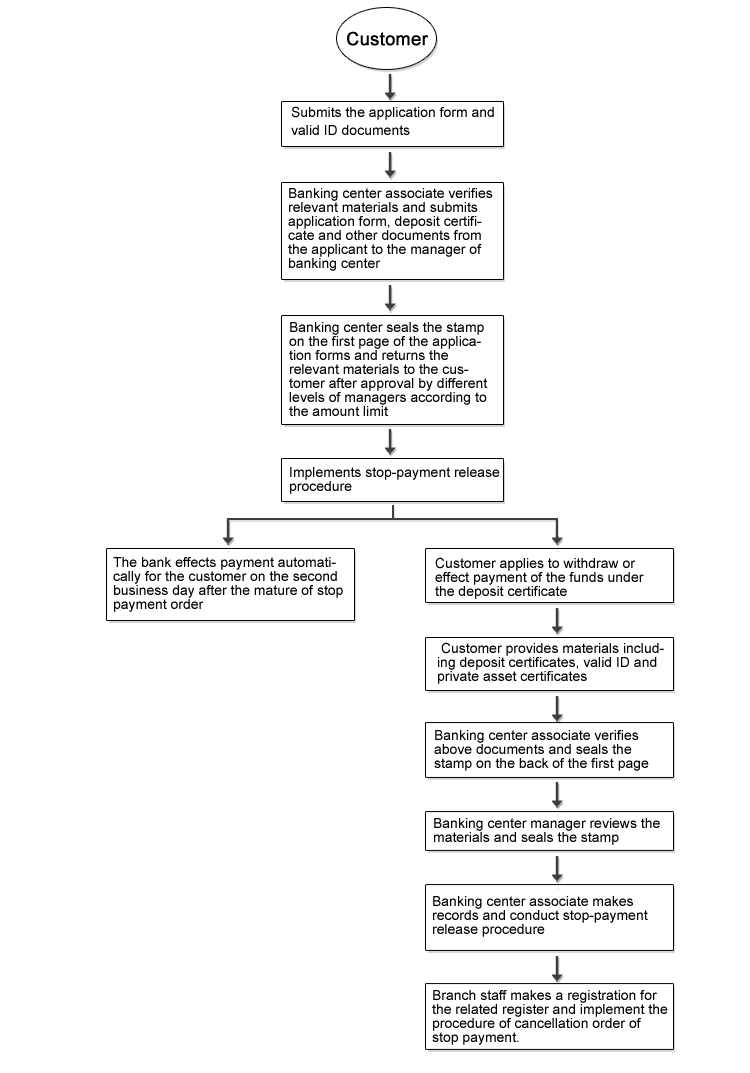

Flowchart