Four major reasons for selecting CCB’s personal foreign exchange trading

1. Flexibility in transactions. The client may choose to do transactions over the counter, at a self-service terminal, by phone, through online banking, or by cell phone. 24-hour services are already available in some CCB branches.

2. Availability of a variety of currencies. CCB offers this service in 9 foreign currencies, namely, the U.S. dollar, Japanese yen, Hong Kong dollar, British pound sterling, Euro, Swiss frank, Canadian dollar, Australian dollar and Singapore dollar. In total, 36 currency pairs are available.

3. Real time updates of the international foreign exchange market. CCB’s bid and offer quotations are closely linked with the real time trading price of the international market. The information is updated in real time and professionals will follow closely the fluctuation of the market.

4. Low threshold for minimum trading amount of a market or entry order, which is set by each CCB branch on the basis of local market conditions. The minimum amount is USD 10 or the same value of other currencies.

Functions

Individuals who have foreign currency deposit accounts with CCB may apply to CCB, and if approved, buy and sell between two currencies through a CCB teller, by phone, or online at the exchange rate published by CCB.

CCB only offers spot transactions. The individual client must hold sufficient foreign currency for the transaction, and the transfer and settlement of funds are accomplished at the completion of the transaction.

The client can choose between market orders and entry orders. Market orders are settled at the exchange rate published by CCB; in an entry order, the client specifies an exchange rate; at the time the market exchange rate meets the requirement, the order is settled; otherwise, the order will remain open for 24 hours or automatically expires at the end of the week. Before an entry order is settled, the client can cancel it. However, an entry order that has been settled may not be cancelled.

Four types of entry orders are available, namely, take-profit orders, stop-loss orders, one-cancels-the-other orders, and if-done orders. The latter three types of orders can only be placed over the counter, at a self-service terminal, or by phone.

Target Clients

The target clients of this service are Chinese residents who have foreign currency deposit accounts with CCB or who hold foreign currency in cash, and foreign nationals who have resided in China for over one year.

Means and Time of Transactions

Currently, you can choose to conduct your transactions over the counter, at a self-service terminal, by phone, online, or by cell phone.

A client who has opened a foreign currency account with a CCB outlet that offers services in foreign currencies may engage in individual buying and selling of foreign exchange.

Over the Counter: You may file an Application for Personal Foreign Exchange Trading at a CCB outlet that offers the service, and present your foreign currency bankbook, CDs, cash or 19-digit savings card. Then you can place market or entry orders.

At a Self-service Terminal: CCB provides self-service terminal at outlets that offer the service. You can follow the instructions on the screen, conduct transactions, make inquiries and print out receipts.

By Phone: With a touchtone phone, you can follow the voice instructions, conduct market or entry transactions, inquire about exchange rates and fax documentation.

Online: Please log on to www.ccb.com and sign a contract. After our verification, you can engage in personal foreign exchange trading online.

By Cell Phone: To enable our clients to conduct transactions anywhere and at any time, CCB has worked with China Mobile and China Unicom to offer transactions by cell phone. After you purchase a STK card from China Mobile or China Unicom and sign a contract with CCB, you will be able to engage in personal foreign exchange trading and make inquiries (at the rate of short messaging) with a regular cell phone.

Some CCB branches now offer 24-hour services in personal foreignexchange trading.

Business Hours over the Counter or at a Self-service Terminal: 9 a.m. to 6 p.m. Monday through Friday. (Not closed during lunch break. Holidays and special business hours are posted at CCB outlets and made available at 95533, our customer services helpline. )

Business Hours by Phone, Online, by Cell Phone: 7 a.m. Monday through 4 a.m. Saturday, without a break. (Holidays and special business hours are posted at CCB outlets and made available at 95533, our customer services helpline.)

Different CCB branches may offer different means of trading and operate during different hours, as CCB is in the process of making its foreign exchange trading services more readily available. For more information, please consult the websites of CCB branches.

Currencies and Minimum Amount

CCB offers this service in nine foreign currencies, namely, the U.S. dollar, Japanese yen, Hong Kong dollar, British pound sterling, Euro, Swiss frank, Canadian dollar, Australian dollar and Singapore Dollar. In total, 36 currency pairs are available.

The minimum amount of a market or entry order is set by each CCB branch on the basis of local market conditions.

The Setting of Market Exchange Rates and Better Rates for Large Transactions

CCB sets market exchange rates for personal foreign exchange trading according to the real-time rates in the international markets. The mean of bid and offer is taken, and points are added or subtracted to arrive at CCB’s bid and offer quotations. When calculating the exchange rate between two foreign currencies, CCB uses the US dollar, instead of the RMB, to arrive at the cross rate, and thus reduces cost for our clients.

CCB sets four market exchange rates for convertible bank-notes bid, convertible bank-notes offer, cash bid and cash offer respectively. These rates follow international market rates and change in real time. You can access CCB’s real-time market rates by monitoring the large screen at a CCB outlet, at a self-service terminal, by phone, by cell phone, online or through an exchange rate paging service. In addition, we provide foreign exchange analysis terminals at CCB outlets that offer personal exchange trading services, to facilitate your sound decision-making and operations.

CCB market exchange rates are updated approximately every six seconds and accurately reflect fluctuations in the international market.

CCB offers better rates for large single transactions, which helps you lower transaction cost and improve profitability. When a client trades in an definite amount of U.S. dollars, CCB decides directly whether the USD amount is large enough to merit a discount; when a client trades in currencies other than the USD, or in an indefinite amount of the USD, CCB first converts into the USD, at the market rate that prevails at the time of settlement, the currency traded, and then decides whether the USD amount is large enough to merit a discount.

Client Process

Nature of Trading

A client may visit a CCB outlet that offers services in personal foreign exchange trading, present a demand deposits bankbook, a term deposits bankbook, a CD, cash, or a 19-digit savings card, and conduct trading there. He or she can trade at a CCB self-service terminal with a 19-digit savings card, by phone, online, or by cell phone after signing a contract. A client can visit a CCB outlet that offers services in foreign currency deposits, present valid identification, and apply for a 19-digit savings card. When opening an account, the client must read thoroughly the Note to Clients of Personal Foreign Exchange Trading and fill out a Commitment Form for Personal Exchange Trading.

Over the Counter Trading Process

When trading at CCB, a client should fill out carefully an Application for Personal Foreign Exchange Trading (two copies), providing the applicant’s name, ID number, account number or amount of cash, the date of trading, the currency to buy, the currency to sell, and the amount. If the applicant chooses to place a market order, he or she should note “market order” in the exchange rate column; if the applicant chooses to place an entry order, he or she should specify a rate in the exchange rate column. The application should be submitted to a teller.

After settling a market order, the teller will provide you with a Confirmation of Personal Foreign Exchange Trading, which signifies a successful transaction

After settling an entry order, the teller will provide you with an Agency Agreement for Personal Foreign Exchange Trading. Before the order is settled, the client can fill out a Cancellation of Personal Foreign Exchange Trading to cancel the order. If the entry order has been settled, however, the cancellation cannot take effect.

Self-service Terminal

Market Order: The client can insert a 19-digit savings card into a self-service terminal, enter a six-digit password on the keyboard to the right of the screen, and make selections by touching the screen. He or she may choose: foreign exchange trading, market order, buy/sell transaction (select “buy” to enter the amount to buy, and “sell” to enter the amount to sell), nature of account (cash or convertible bank-notes), the currency to buy, the currency to sell. The client can enter the mount to buy or sell on the keyboard. (Because the terminal is preset to display two decimal places, the client does not need to enter the decimal point. For example, 587.15 is displayed if the client enters 58715 and presses the “enter” key; 500 is displayed if the client enters 50000 and presses the “enter” key. No decimal place is displayed for the Japanese yen. )

Entry Order: If the client selects “entry order” after selecting “foreign exchange trading,” and confirms the two currencies in which to trade, the system will display the market exchange rate. The client can then enter an exchange rate (take-profit rate or stop-loss rate). After placing the order, the terminal will print out a confirmation, and then the client is logged out of the system.

Selecting an Exchange Rate for an Entry Order: After a client places a take-profit order, the system will check the order; when CCB market exchange rate falls to or below the “buy” rate, or rises to or above the “sell” rate, the system settles the order at the market exchange rate. After a client places a stop-loss order, the system checks the order; when CCB market exchange rate rises to or above the “buy” rate, or falls to or below the “sell” rate, the system settles the order at the stop-loss rate specified by the client. If CCB market exchange rate does not meet the client-specified rate, the order remains open for 24 hours (starting from the time the order is placed) or automatically closes at the end of the week’s trading.

When an order is settled, the amount of currency sold is transferred out of the client’s account, and the amount of currency bought is transferred into it. The details of the transaction, including the time of the transaction, the currency bought, the currency sold, amounts, and the exchange rate, are recorded in CCB Confirmation of Personal Foreign Exchange Trading. The client is advised to remember the transaction number, and to request a printout of the Confirmation at the counter or at the self-service terminal, or request a faxed copy of the Confirmation by phone.

Trading by Phone (95533)

For detailed information, please refer to the Methods for Personal Foreign Exchange Trading by Phone.

Trading Online

After signing a contract at www.ccb.com and being approved, the client can trade in foreign exchange online. Online transactions include: market order, entry order, canceling entry orders, inquiring into entry orders (single transaction, detailed records), inquiring into settlement (single transaction, detailed records), inquiring into account balance, inquiring into detailed transactions in an account, and inquiring into market exchange rates and trends in exchange rates.

When opening an account for online trading, the client must provide personal information, namely, the client’s name, age, ID number, ID type, account number, branch where the account is open, and account password. The Internet banking center will return the following information: the certificate CN number, account name on the Internet banking system, log-in password, transaction password, and URL that links to the website where the certificate may be downloaded. After signing the contract, the client may enter the personal foreign exchange trading system and start trading.

If you encounter any technical problems when opening an account for online-trading, please contact our customer service center at 95533.

Trading by Cell Phone

To enable our clients to trade anywhere and at any time, CCB has been working with China Mobile and China Unicom to offer trading by cell phone. After you purchase a STK card from one of these companies and sign a contract with CCB, you can start personal foreign exchange trading and make inquiries with a regular cell phone. The advantages of this means of trading are that such trading is not limited by the time or place, that the client is charged at the relatively low short-messaging rate, and that the trading is convenient and safe. Currently, CCB offers the following services by cell phone: buying and selling, canceling entry orders, inquiring into entry orders, inquiring into settlements, inquiring into market exchange rates, and faxing.

Client Process

1. Opening an Account

Individual clients who have already opened a foreign exchange deposit account with CCB may apply for personal foreign exchange trading with valid documents. Those who have not had such an account with CCB must provide required documents to open an account before they can apply for trading.

2.Placing an Entry Order

When a client places an entry order with CCB over the counter, by phone, by cell phone, at a self-service terminal, and online, CCB’s current transaction host automatically checks whether there is sufficient foreign currency to sell in the client’s account, and decides on the basis of the market exchange rate whether the exchange rate specified by the client meets trading requirements.

3. Settling

If the order cannot be settled within the valid trading period, the entry order is automatically cancelled at the end of the day on which the order is placed. If the order is settled within the valid trading period, CCB settles the funds with the client on a real-time basis.

4. Transfer

On the day interest starts to accrue, the client and CCB transfer funds between their accounts.

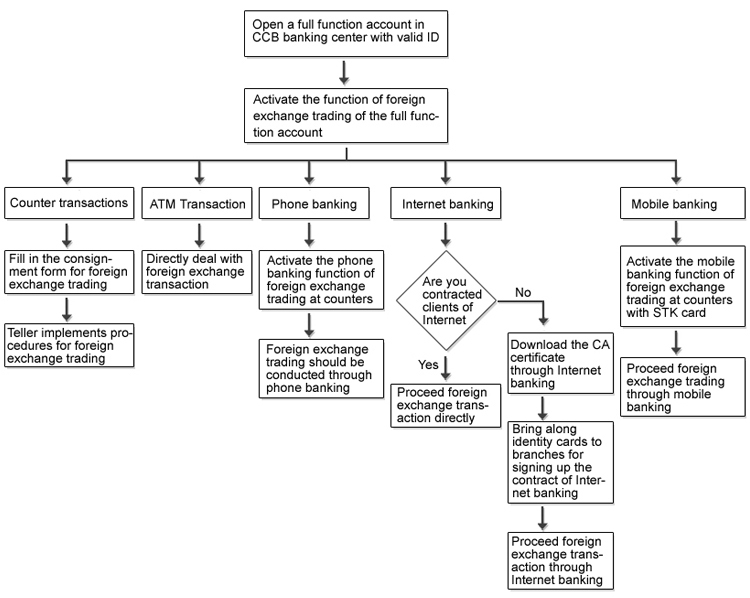

Trading Flowchart

Special Notes

CCB reserves the right to modify the means, currencies, hours, spreads, contracts, etc. of personal foreign exchange trading according to business strategies and market conditions. When such modifications occur, CCB will announce them at its outlets or through other means.

Before your entry orders are settled, please refrain from changing your bank cards, canceling or freezing your accounts, or reporting the loss of your bank cards; if such actions are necessary, please cancel your entry orders first. When an entry order is open (one that is neither settled nor cancelled), the amount of currency sold cannot be withdrawn or used.

When placing a market order, the exchange rate at which your order is settled may be different from the rate you know, because of a delay in communications.

The market exchange rate used in personal foreign exchange trading goes by the rate quoted by CCB host (the rate quoted by telephone banking, the monitor on the trading floor, and the self-service terminal). Rates quoted in other ways are only for your reference.

Without definite evidence to the contrary, evidence produced by CCB of the currencies, volume, date, time, exchange rate, and client-specified exchange rate of a trade is considered final. The client should request proof of trading in a timely manner; if the client has doubts, he or she is advised to raise them within three business days of the trade.

A trade cannot be canceled after it is completed.

CCB provides analysis of the foreign exchange market through terminals available at each outlet that offers trading services. The client can use terminals during business hours to research market trends and obtain other information. The client can also go online to research the market exchange rates, trends, commentary on the market, financial news and our foreign exchange services, and to simulate foreign exchange trading. He or she can also open an account with a paging service to inquire into the market exchange rates, trends, and analysis of the market. CCB also offers commentary on the market regularly through the media.