- Personal

-

- Long Credit Card

- Installment Service

- Application

- Activate Your Card

- Product Overview

-

- Long Card Services

- Long Card All-in-One

- About Long Card Network

- Wealth Management Cards

-

- Personal Loans

- Personal Business Loan

- Personal Car Loan

- Personal Housing Loan

-

- Gold Business

-

Physical Gold for Persona-

l Investment - Personal Gold Account

-

- Foreign Exchange

-

Individual Exchange Settl-

ement and Sales -

Individual Foreign Exchan-

ge Remittance - Personal Foreign Exchange Options

- Personal Foreign Exchange Structured Deposits

- Personal Foreign Exchange Trading

-

Foreign Currency Conversi-

on -

Personal Purchase of Fore-

ign Exchange -

Permit to Carry Foreign C-

urrency Abroad -

Foreign Currencies Travel-

ler's Cheque

-

- Service for Your Co-

nvenience -

Different-Location Collec-

tion - Paying Salaries on Behalf of Organizations

- Third-party Payment

- Safes

- Insurance Agent

- Swift Remit

- Service for Your Co-

-

- Personal Wealth Man-

agement Products - Profit from Interest

- Personal Wealth Man-

- Corporate

-

- Corporate E-Banking

- VIP Service System

-

Corporate Online Banking -

(Simple) -

Corporate Online Banking -

(Advanced)

-

- International Business

- International Settlement

- International Financing

- FI Services

-

- Intermediary Business

- Guarantee-Based Business

- Consulting and Advising

- Factoring

Foreign Currency Conversion

Product Description

Foreign currency conversion is defined as the conversion between foreign currency cash/convertible bank notes and the RMB Chinese and foreign residents at approved CCB outlets and authorized conversion agencies. According to China’s foreign currency regulations, Chinese residents who hold foreign-currency cash or deposits may convert the foreign currency into other foreign currencies or the RMB at the exchange rates set by the People’s Bank of China at a CCB foreign currency counter. However, they may not convert their RMB into foreign currency. Therefore, Chinese residents can only convert one foreign currency into another, or into the RMB. Only foreign visitors, foreign nationals of Chinese descent, and residents of Hong Kong, Macau and Taiwan may convert their unused RMB into foreign currency, when they leave China.

Three major reasons for selecting CCB’s foreign currency conversion

1. High credibility. CCB, as a well-known domestic and international bank, may offer integrated services.

2. Professionalism. The tellers all obtained the qualification for conducting foreign exchange transactions, with service quality guaranteed.

3. Unified price. CCB will comply with the rates set by the PBC.

Functions

1. Conversion of foreign currencies into RMB. In accordance with the regulations of PRC, Chinese residents can only convert their foreign currencies into RMB. Foreign residents in China can convert their RMB into foreign currencies or vice versa.

2. Foreign residents may convert their unspent RMB back into their currencies within the validity period and the original converted amount. The validity period last for 6 months from the day the conversion takes place.

3. Collection: CCB may collect the old foreign currencies, which have been stopped from circulating but still have values and can be converted at the issuing banks without day with the consent of the currency holder.

Service Channels

The channels include the approved CCB outlets and the authorized foreign currency conversion agencies. The authorized agencies can only convert foreign currencies into RMB.

Categories

Conversion of foreign currency cash into the RMB, and of foreign currency convertible bank notes into the RMB. Conversion of the RMB into foreign currency cash, and into foreign currency convertible bank notes when leaving China.

Currencies and Terms

1. Currencies

Cash in all convertible foreign currencies, and convertible bank notes in all foreign currencies that can be legally drawn, may be converted into the RMB, provided that CCB trade in these currencies.

2. Terms

Usually the U.S. dollar, Japanese yen, Hong Kong dollar, euro and British pound sterling are available. The RMB can be converted into these currencies at any time, provided that the required documentation is presented.

Rates

Currencies are converted at the rates published by the People’s Bank of China and the State Administration of Foreign Exchange.

Client Process

1. Regular Clients

Regular clients must apply for CCB to convert their foreign currencies into the RMB, and fill out a form confirming their receipt of RMB funds.

2. Visitors to China

Foreign visitors, foreign nationals of Chinese descent, and residents of Hong Kong, Macau and Taiwan, may present their passports and “receipts of foreign currency conversion” (valid for six months) to CCB and request that CCB convert their unused RMB back into their currencies.

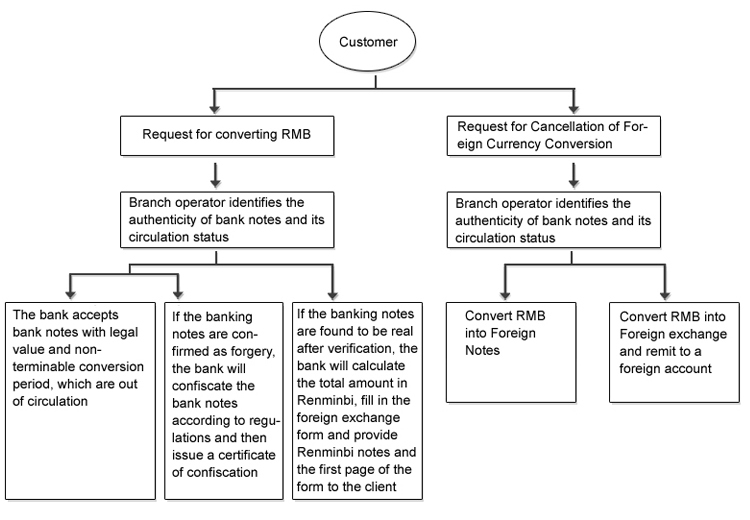

Flowchart