|

Step One – Activate the Card You have to activate your each card before use. Whenever receiving your card (whether it is a principal card or supplementary card, including newly issued card, , replacement card for damage or lost, and renewal card on expiration), please activate your card either by phone or online as follows:

Activate Your Card by Phone Please call the 24-hour service hotline (400-820-0588. Please dial 021-38690588 if you are in a non-400 service area or dial 86-21-38690588 if you are overseas). Input your card number or ID number. Verify your identity and set the password for phone banking. Press 2 for option of “card activation and password setting”, then press 1 to process the card activation as instructed by the voice instruction.

Note: I. Each cardholder will have one phone banking password. For principal cardholders and supplementary cardholders, please set your card passwords respectively. II.If you have more than one principal card, you only need to set your phone banking password when you activate your first card. The same password will be applied to other cards you own.

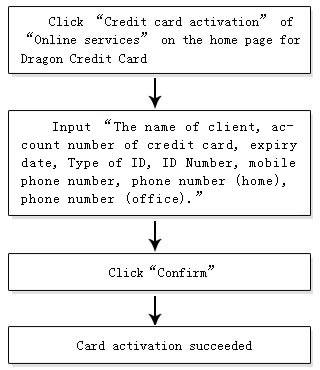

Activate Your Card Online

Note: I. You would have to activate your card through the 24-hour service hotline customer service agent (CSR) if you have failed to activate your card online for three times. Only the principal card can be activated online. Please activate supplementary card through the service hotline.

Step Two – Set the Password (1) After activating your card, you should set the payment/cash withdrawal password in time . 1) If you activate your card by phone, please continue to set the password for payment/cash withdrawal as instructed by voice instruction; 2) If you activate your card online, please call the 24-hour service hotline (400-820-0588; or dial 021-38690588 if you are in a non-400 service area; or dial 86-21-38690588 if you are overseas) to set the password for payment/cash withdrawal by contacting the CSR. (2) Each card will have one password for payment/cash withdrawal. Cardholders please respectively set the password for payment/cash withdrawal for every card they own. Password for payment/cash withdrawal is required in the following circumstances: 1) Both abroad and domestic cash withdrawal. 2) Domestic consumption payment for customers who select to “Identify password for domestic consumption”. (3) You can change the password for payment/cash withdrawal anytime by the password changing function on our ATMs. (4) Please call our 24-hour service hotline in case you forget your password, we will help you with password resetting.

|